CBI’s Carolyn Fairbairn says ‘a new approach is needed … jobs and livelihoods depend on it’

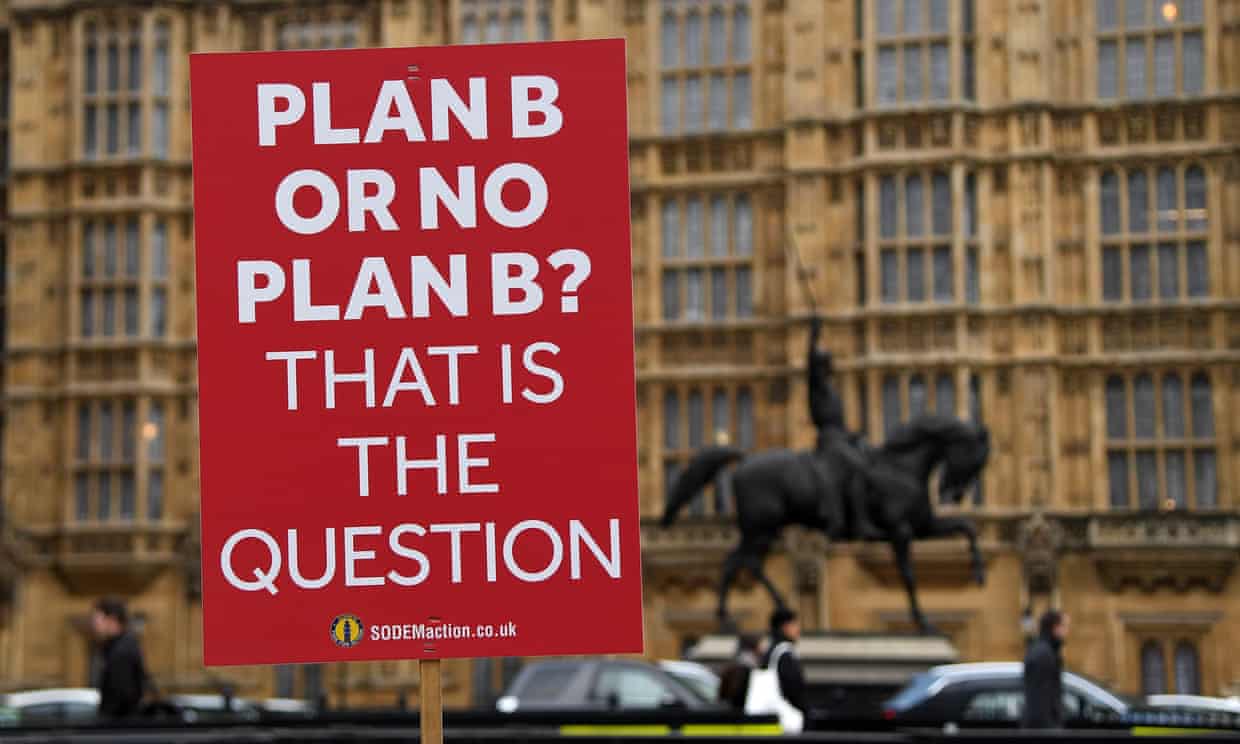

Business groups have reacted with dismay to parliament’s second rejection of Theresa May’s Brexit deal, saying they were exasperated by the lack of clarity over the UK’s trading arrangements with the European Union after 29 March.

The pound briefly recovered some of its losses during the day in the minutes after the vote on Tuesday, before sliding again as currency traders worried that a no-deal Brexit had become the more likely outcome.

Carolyn Fairbairn, director general of the CBI, said businesses wanted all sides in parliament to back a plan to avoid crashing out of the EU.

Describing the past few days in Westminster as “a circus”, she said: “Enough is enough. This must be the last day of failed politics. A new approach is needed by all parties. Jobs and livelihoods depend on it.

“Extending article 50 to close the door on a March no-deal is now urgent. It should be as short as realistically possible and backed by a clear plan.”

Business groups have vigorously campaigned in recent months against leaving the EU without a deal, which they believe will harm exports and potentially cause chaos at UK ports, disrupting vital imports.

Adam Marshall, director general of the British Chambers of Commerce, said businesses were not ready to face the consequences of “a messy and disorderly exit” from the EU.

“Government agencies are not ready, many businesses are not ready, and despite two and a half years passing since the referendum, there is no clear plan to support communities at the sharp end of such an abrupt change,” he said.

“Parliament must demonstrate that it will heed these repeated warnings. It is profoundly obvious that neither government nor many businesses are ready for a disorderly exit – and this must not be allowed to happen on 29 March, whether by default or by design.”

A succession of warnings – and some actions – by the UK car industry, which is almost entirely foreign-owned, have spooked ministers, who fear large parts of the industry could shift abroad following a no-deal Brexit.

On Tuesday Nissan announced that it would stop making its luxury Infiniti brand at its Sunderland factory by July, putting 250 jobs at risk. Honda is planning to close its factory in Swindon, putting 3,500 jobs at its only European production site at risk and a similar number in its supply chain.

Other carmakers, including BMW and Toyota, have signalled that they may need to shift production out of the UK should parliament opt for a no-deal Brexit.

Currency traders sold the pound in the run-up to the Commons vote, sending it down to almost $1.30 after it started the day at $1.32. Sterling fell almost 1% against the euro to €1.16.

The pound briefly rallied in the minutes after May’s latest defeat, touching $1.315, before falling back again.

In the City, the FTSE 100 index of blue chip shares closed 20 points higher at 7,151. Other European markets also ended the day up slightly, though the German Dax slipped marginally by 19 points to 11,924 and the Spanish Ibex fell 10 points to 9,161.

The Investment Association said it was “extremely disappointing” that after a long period of negotiations and a second meaningful vote, the Brexit uncertainty continues.

With more than £19bn of savings leaving the country since the Brexit vote, the group, which represents City fund managers, said savers were sending their funds abroad to avoid a no-deal Brexit.

Chris Cummings, chief executive of the association, said: “Given the continued uncertainty that today’s result brings, the industry has no option but to implement their long-established no-deal contingency plans.”

The Guardian

Leave a comment